CAC Reduction Strategies for 2026: The Agentic Approach

In 2021, the advice to founders was: "Growth at all costs." In 2026, the advice is: "Default Alive." The metric that kills companies today isn't ARR. It's CAC Payback Period.

If it takes you 18 months to make back the money you spent to acquire a customer, you are just financing your own funeral. You will run out of cash before you reach scale.

The Old Equation is Broken

Let's break down the traditional SaaS Go-To-Market cost structure:

- Ads (LinkedIn/Google): $500 - $1,000 per demo. (And rising every year).

- SDR Teams: $120k fully loaded per head.

- Events: $50k for a booth.

It is bloated. It is inefficient. It is manual.

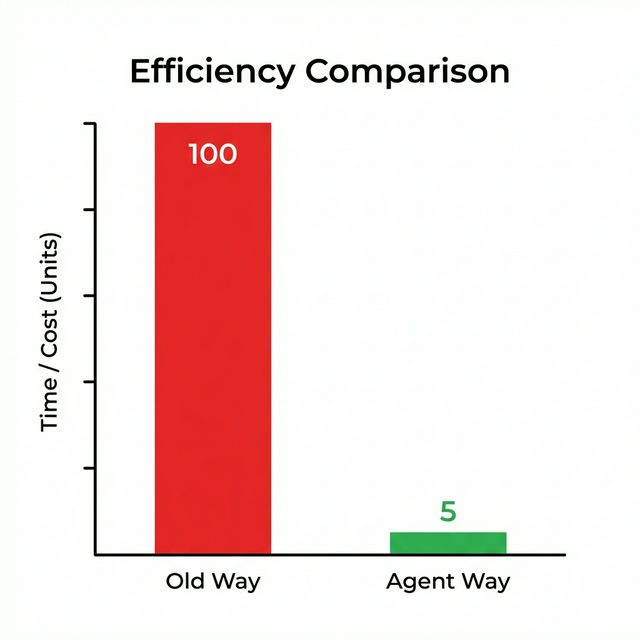

CAC Reduction Chart

The Agentic Model

Arbitrage

Here is the secret that the fastest growing companies know: Software borders on zero marginal cost. Humans are linear costs.

When you replace a manual process (SDR outreach, ad bidding, content writing) with an Agentic process, you decouple your growth from your expenses.

Strategy 1: The "24/7 SDR"

Instead of paying a human $80k to send 50 emails a day, pay an agent $12k to send 5,000. Result: Your "Cost Per Meeting" drops from $500 to $50.

Strategy 2: Programmable SEO

Stop paying agencies $5k/month for 4 blog posts. Use Content Agents to publish 50 high-quality, data-backed articles a month. Dominating long-tail keywords ("Best CRM for Fintech under 50 employees") is a volume game. Agents win volume games.

The CFO's Dream

When you present your board deck, showing a CAC Payback of 4 months (vs industry average of 14), you don't just get a pat on the back. You get a higher valuation multiple. Investors pay for efficient growth.

Conclusion

You can't "optimize" your way out of a bad business model. Tweaking ad copy won't fix a broken CAC. You need to change the model. Swap labor for software. Swap ads for organic agentic reach. That is how you survive—and thrive—in 2026.